|

Are covered calls the best strategy in a raging bull market, like we've had in the last couple of months? No. But they're not a horrible choice, either. Just because you didn't make as much as you could have (if you hadn't written calls) doesn't mean you should abandon your conservative investment strategy.

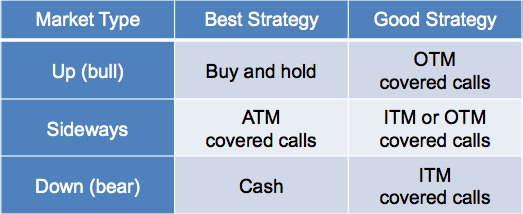

To illustrate our thoughts on the matter we've put together a chart showing what the 'best' and 'good' strategies are for each market type:

Obviously, in a strong up market you just want to stay long on stocks and let them ride. If you're nervous about a correction, or just want to get a little extra income then a good strategy is to sell out-of-the-money covered calls.

In a sideways market selling at-the-money covered calls is the best strategy. The time premiums are highest in ATM options so you will maximize your income with this strategy. If you are slightly bullish then sell slightly out-of-the-money calls instead. And if you're slightly bearish then sell slightly in-the-money calls.

In a down market, the best strategy is not to be in it. Just hold cash. If you want to try and get some income in a down market then buy solid companies (not high fliers, momentum stocks, or stocks about to release earnings or FDA announcements) and sell in-the-money-calls against them. You'll have the most downside protection with ITM options.

Bottom line: Covered calls may not be the 'best' strategy in every market, but they are a 'good' strategy in any market. When used over a long period of time you should come out ahead by using a consistent covered calls strategy. The highs may not be as high (compared to buy-and-hold), but the lows certainly won't be as low, either.

|