| Selling Covered Calls In May Was A Good Call |

|

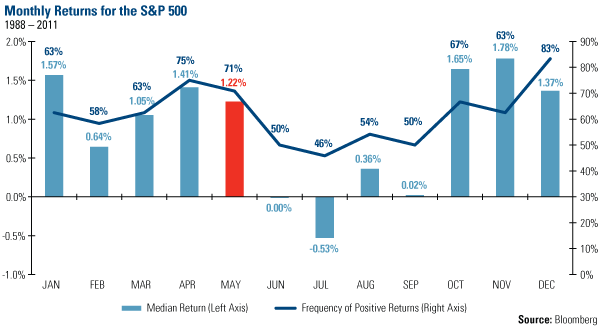

On May 7 we published a blog article suggesting you sell in-the-money covered calls for the month or for the summer. This was based on the historically weak summer months for the S&P 500, as seen in this chart showing median returns by month for the last 25 years:

Given last month's performance, the in-the-money strategy was the right call. Despite the drop in May, all 6 suggested trades (AAPL, CRM, LNKD, CRUS, GOOG, VHC) with expiration dates of Aug 18 or Sep 22 are still in-the-money, and will yield annualized returns of 15.9% to 24.8% if they stay in-the-money. To read the full article, please see Sell (Covered Calls) In May An Go Away.

|

| More Apple Income |

|

Many people make a living off of writing covered calls on AAPL. The at-the-money weekly options often pay annualized returns of 80% or more. Of course, writing at-the-money options increases risk should the underlying drop by more than the option premium received, as AAPL did for many people in May.

The solution is to reduce your return expections and write in-the-money or deep-in-the-money options instead of at-the-money. In the last several weeks we've completed 3 cycles with this strategy:

- May 8: all 3 strikes called away for annualized returns of 25% to 53% over 5 days.

- May 14: all 3 strikes not called, but then on May 21 were re-written at the same strike and then succcessfully called on May 25 for annualized returns of 52% to 79% over 12 days.

- May 29: all 3 strikes called away for annualized returns of 21% to 51% over 4 days.

You can read about the trades in May 8, May 21, and May 29 blog entries.

|

| Free Covered Call Books Giveaway |

|

Like Born To Sell? Help us get the word out and you could win a free book on covered call investing, or an iTunes gift card:

There are 8 ways to enter (Facebook, Twitter, Google+, etc). Full details on the Link To Us And Win page. Thanks and good luck in the drawings!

|

| MSFT And 3 Other Covered Calls For Jun 16 Expiration |

|

With 2 weeks to go until the June options expire, the top 4 covered calls Born To Sell members have written are (in order of popularity):

| Rank | Symbol | Strike |

|---|

| 1. | MSFT | 29 |

| 2. | AAPL | 585 |

| 3. | CHK | 15 |

| 4. | INTC | 26 |

(Note: Born To Sell members have access to the full Top 10 Covered Call list, as well as having this list update real-time as members change positions. These are not recommendations, they are merely a reflection of our members' current positions.)

|

| INTC And Other Covered Call Watchlist Stocks |

|

Currently, the top 8 stocks Born To Sell members are using for their Watchlist are (in order of popularity):

| Rank | Symbol |

|---|

| 1. | INTC |

| 2. | MSFT |

| 3. | AAPL |

| 4. | GE |

| 5. | CSCO |

| 6. | T |

| 7. | JNJ |

| 8. | F |

(Note: Born To Sell members have access to the full Top 20 Watchlist, as well as having this list update real-time as members change their watchlists. And, you can have the highest yielding covered calls from your personal watchlist emailed to you after the close each day. Never miss a fat premium from your watchlist again!)

|

| Want More Covered Call Goodness? |

|

Born To Sell is dedicated to only one thing: Making Money With Covered Calls. Our subscribers have access to state-of-the-art covered call screeners and covered call portfolio management tools. For less than the profit of a single trade you could be enjoying recurring monthly income using our tools. Three subscription types to choose from:

| Term | Price |

|---|

| Monthly | $59.95 |

| Quarterly | $149.95 (17% discount) |

| Annual | $499.95 (31% discount) |

Plus, all subscriptions begin with a no-obligation 2-week free trial. What are you waiting for? Start collecting premium today!

Happy Trading,

The Born To Sell Team

|