Covered Calls For Income

Writing covered calls for income is a great way to increase your portfolio yield. Combining call option premium with solid dividend yields on blue chip stocks will increase your annual income to 10% or more, typically.

Good Stocks For Generating Covered Calls Income

If you don't yet own the stocks you want to use for covered call income then a good place to start is with the S&P 500 stocks that pay dividends. From that list you should remove anything that has an earnings announcement before option expiration (assuming you're selling near-month options), as well as anything that has a pending FDA announcement or is part of an M&A rumor. Those kind of high volatility events can wreak havoc in a covered call portfolio designed just for income.

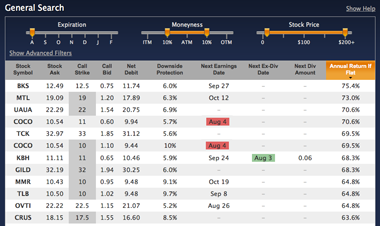

Fortunately, covered call screeners make this kind of filtering easy. Born To Sell's screener, for example, lets you remove all covered calls that have earnings before expiration, and lets you include only those covered calls that have an ex-dividend date prior to option expiration. Great tool for a dividend capture strategy – you collect dividends without fear of earnings announcements. Here's what the screener looks like:

Anyone who is serious about using covered calls for income is going to want to diversify across industry sectors. Probably best to sell in-the-money or deep in-the-money options, too. You won't leave yourself any room for upside potential but since you are working on an income-oriented portfolio you will appreciate the reduction in risk if you stick to in-the-money covered calls.

If you would like to learn how to write covered calls for income, sign up for our free newsletter or a 2 week free trial of our service.

Born To Sell is dedicated to having the best covered call income tools available. In addition the screener, we have several portfolio management tools designed to help you maximize your monthly income.