Invest In Stargate AI

What is Stargate?

Stargate is a massive AI joint venture between OpenAI, SoftBank, and Oracle. An infrastructure project building AI data centers in multiple locations across the US. It has a planned $500B of investment, about $100B each year from 2025 to 2029. The first site is under construction in Abilene, Texas, and spans 875 acres with plans for 10 buildings, each around 500,000 square feet.

Stocks Benefiting from Stargate Data Center Buildout

Several categories of companies should benefit from the $500B in spend. Many of these sold off last month because (1) they were priced historically high, and (2) increased uncertainty around tariffs and inflation. Having said that, these are strong companies selling into multi-year AI demand growth globally. It might be a good time to enter new positions and write some in-the-money covered calls. Examples include:

1. Semiconductor and Chip Manufacturers

-

Nvidia (NVDA)

- The leading provider of GPUs critical for AI training and inference, and it’s explicitly involved in Stargate as a technology partner. With a forward P/E of 32 and projected 35% annual earnings growth over five years, Nvidia is well-positioned as data center demand surges. Another GPU maker to look at is Advanced Micro Devices (AMD).

-

Taiwan Semiconductor Manufacturing Company (TSM)

- The world’s largest contract chip manufacturer produces Nvidia’s GPUs and other advanced chips (e.g., 3nm and 5nm technologies). Its role in the supply chain makes it a key player as data center spending rises. Q4 2024 revenue surged 37%, and gross margins hit 59%, reflecting strong pricing power and demand.

-

Micron Technology (MU)

- Supplies DRAM and NAND flash memory, essential for AI data storage and processing. The scale of Stargate’s data centers will likely boost memory demand. Analysts flag Micron as a sleeper hit for AI infrastructure due to its memory leadership.

2. Data Center Infrastructure and Equipment Providers

-

Vertiv Holdings (VRT)

- Provides power, cooling, and infrastructure solutions for data centers. As Stargate’s data centers scale up, demand for thermal management and reliable power distribution will increase. A critical enabler of AI server deployments.

-

Super Micro Computer (SMCI)

- Designs high-performance servers optimized for AI workloads, a good fit for Stargate’s needs. Its stock is tied to AI infrastructure growth, including many hyperscale projects. Might want to also consider Dell (DELL).

-

Arista Networks (ANET)

- Supplies Ethernet switches and networking gear, key for connecting Stargate’s data center processors. It’s a supplier to Oracle, a Stargate partner. Barron’s highlights Arista’s 7% stock jump post-Stargate announcement, signaling market confidence.

3. Power and Energy Companies

-

Constellation Energy (CEG)

- A nuclear power leader, already partnering with Microsoft on similar projects (e.g., Three Mile Island). Stargate’s energy needs align with its low-cost, efficient power offerings. Up significantly in 2024, it secured $1 billion in contracts in January 2025.

-

Vistra Corp (VST)

- Provides nuclear and gas-powered electricity, ideal for data centers’ constant energy demands. Hedge funds bought Vistra last year, anticipating AI-driven power needs.

-

NextEra Energy (NEE)

- A renewable energy giant with solar and wind contracts (e.g., 860 MW deal with Google), NextEra could support Stargate’s sustainability goals. Up 28% in the past year, with a 30-year dividend growth streak, it’s a stable play for long-term energy demand.

4. Networking and Connectivity

-

Broadcom (AVGO)

- Chips to power Arista’s switches and other networking gear, and its transceivers connect processors in data centers. Analysts peg it as a Stargate winner due to its 20% share of AI data center semiconductor spending.

-

Corning (GLW)

- Manufactures fiber optic cables, crucial for high-speed data transmission in Stargate’s facilities. Analysts recommend it as AI networks expand.

5. Consortium Partners and Adjacent Players

-

Oracle (ORCL)

- As a Stargate partner, Oracle will build and operate the data centers, boosting its cloud computing profile (currently 3% market share vs. Amazon’s 31%). The project could elevate Oracle’s status in the hyperscale cloud race.

-

Microsoft (MSFT)

- A Stargate technology partner, Microsoft’s Azure cloud and $13 billion investment in OpenAI tie it closely to the project’s success. Its $80 billion AI data center spend in 2025 complements Stargate’s ambitions.

So Which Covered Calls To Write?

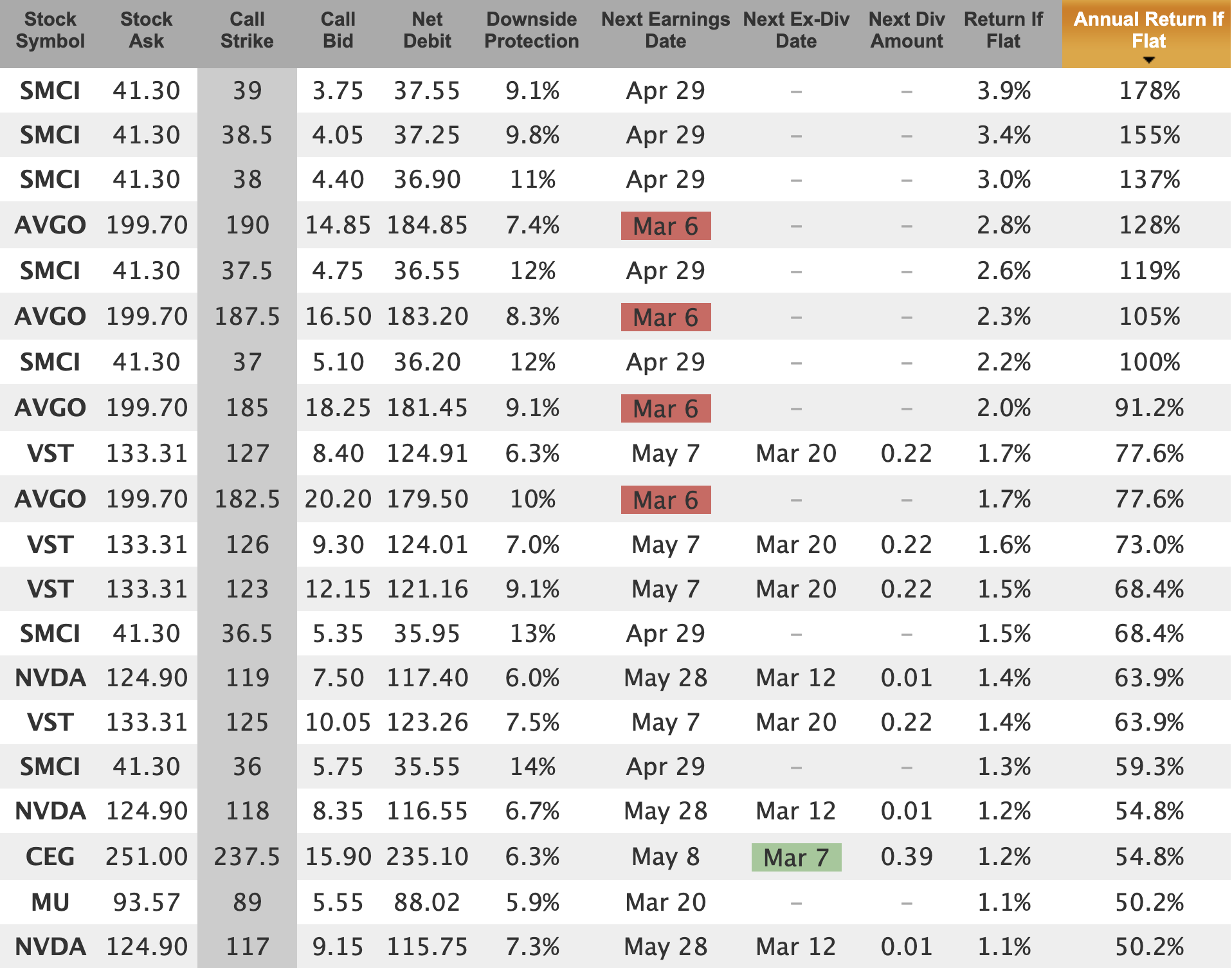

If we take all of the mentioned symbols and paste them into the Watchlist page on Born To Sell, and then limit the results to those 5% or more in-the-money, and set the expiration date to next Friday, March 7, then these are the highest yielding candidates:

Keep in mind that AVGO has earnings on March 6, so if you don't want earnings risk then don't choose that one. And SMCI is experiencing increased volatility due to recent accounting and compliance drama with the SEC. If you're not risk-loving then you may want to avoid that one for a little while.

For the more risk-loving (i.e. less downside protection), here are some weekly covered calls for March 7 that are closer to at-the-money strike prices:

As always, keep your position sizes modest, stay diversified, and do not just choose a covered call because of it's high premium. Do your homework until you know why the premium is high, and then decide if the risk/reward is right for you and your portfolio.

Mike Scanlin is the founder of Born To Sell and has been writing covered calls for a long time.