Tariff-Resistant Stocks With Dividends

Investing In World Full Of Tariffs

Tariffs have a way of shaking up markets, creating uncertainty for investors and volatility in global trade. While no one can predict with certainty whether new tariffs will be imposed, the possibility alone is enough to make many investors rethink their portfolios.

But not all stocks are created equal—some companies are well-insulated from trade disputes and can continue delivering steady dividends (and call premiums) no matter what happens. Let's look at some dividend-paying stocks that are positioned to thrive even if tariffs make a comeback, helping you build a more resilient, income-generating portfolio.

Stocks That Are Less Likely To Be Affected By Tariffs

- Domestic-Oriented Companies. Generate most of their revenue within their home country and rely less on imports or exports.

- Healthcare & Pharmaceuticals. Also relatively insulated from tariffs as they primarily operate in domestic markets.

- Consumer Staples. Produce essential goods that people buy regardless of economic conditions.

- Financial Sector. They don’t rely on physical goods and thus are largely unaffected by tariffs.

- Domestic Manufacturers. U.S.-based manufacturers with minimal international exposure could benefit from tariffs by facing less competition from foreign imports.

Those are good but we also want dividends. Here are some examples in each category along with their annual dividend yield:

These are not stock recommendations, nor are these the only dividend paying stocks within these tariff-resistant sectors. They are just examples to get your creative mind thinking about how tariffs could affect certain industries.

Which Covered Calls To Write?

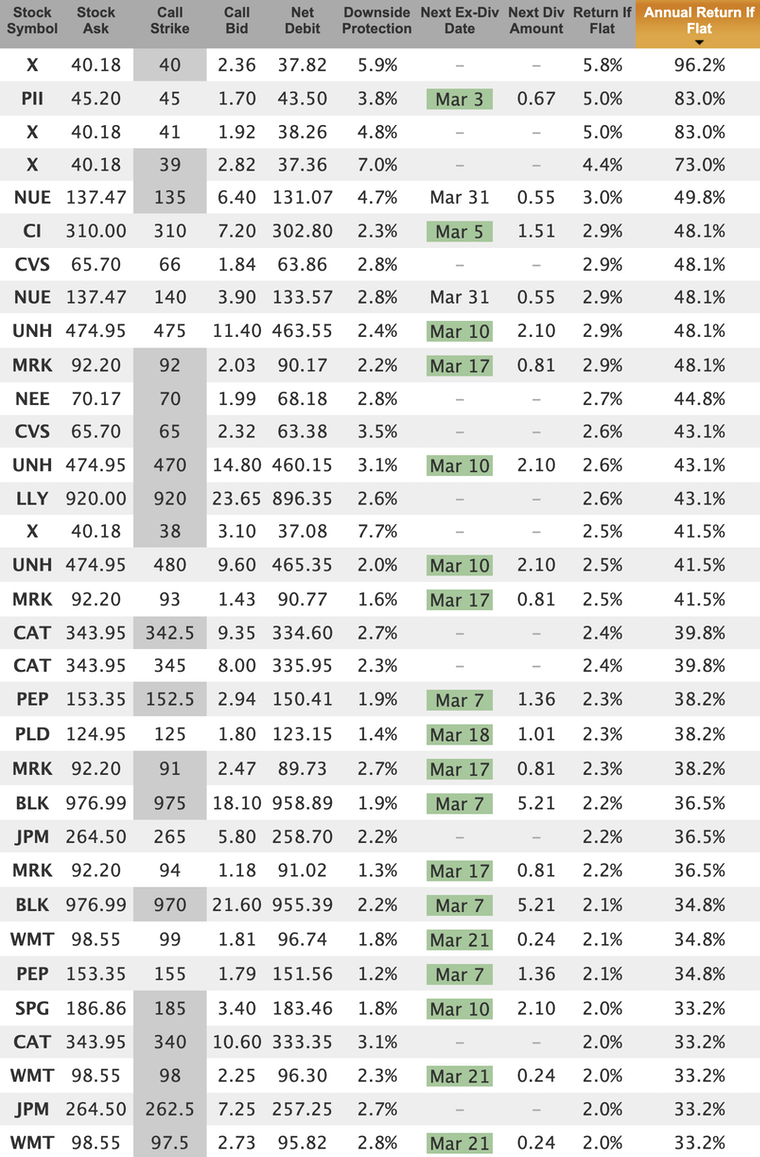

If we take all of the mentioned symbols and paste them into the Watchlist page on Born To Sell, set the expiration date to March 21, and remove those with earnings before expiration (KR, COST), then below are the highest yielding candidates for a 3 week trade.

Many of these have an ex-dividend date before March 21 (shown in green in the Next Ex-Div Date column), so you'd get the dividend plus the call premium. But be aware if the ex-div date is near the option expiration date (WMT, for example, goes ex-div on the expiration date) because if the stock is in-the-money at that time then you will likely be early exercised.

Again, not trade recommendations. Just some ideas to think about as you consider how to tariff-proof your portfolio.

Keep your position sizes modest, stay diversified, and do not just choose a covered call because of it's high premium. Do your homework until you know why the premium is high, and then decide if the risk/reward is right for you and your portfolio.

Mike Scanlin is the founder of Born To Sell and has been writing covered calls for a long time.