Rocket Lab Going To The Moon

Went To The Moon, Going Again In May

Rocket Lab (RKLB) has emerged as a formidable player in the space industry, specializing in small satellite launches with its Electron rocket and developing the larger Neutron rocket to compete in the medium-lift market. The company is also expanding into satellite manufacturing and space systems, positioning itself as a vertically integrated space technology provider. They've already been to the moon, and are planning on going again in a couple of months.

Investing In Space Can Be Volatile

Buying RKLB shares requires a belief in the future. The company has a market cap of $9B today, but lost $189M in the last 12 months on revenue of $436M. As a result, the stock price is volatile:

RKLB Stock Price Last 6 Months

The Bullish Case for Rocket Lab

Expanding Market for Small and Medium-Lift Launches

The demand for satellite launches continues to grow, driven by increased commercial and government interest in Earth observation, communications, and space-based data services. Rocket Lab has positioned itself as a reliable and frequent launch provider, competing effectively against SpaceX in the small-satellite segment. With Neutron, it aims to capture a share of the medium-lift market, directly challenging Falcon 9 for certain missions.

Strong Track Record and Execution

Rocket Lab has successfully completed dozens of Electron launches, demonstrating reliability and operational efficiency. Its ability to achieve consistent launch cadence and mission success provides confidence in its capabilities and credibility among customers, including NASA, the U.S. Department of Defense, and commercial satellite operators.Diversification Beyond Launch Services

Unlike pure-play launch providers, Rocket Lab is expanding into satellite manufacturing and space systems, including propulsion and avionics. This diversification provides additional revenue streams and reduces reliance on launch contracts alone. Notably, the acquisition of Sinclair Interplanetary and other strategic moves have strengthened its position in satellite hardware and end-to-end space services.Strong Government and Defense Contracts

Rocket Lab benefits from a growing pipeline of government and defense-related contracts, which provide stability and high-margin opportunities. As geopolitical tensions increase and nations seek independent launch capabilities, Rocket Lab’s role as a trusted U.S.-based launch and space systems provider becomes even more crucial.Reusability and Cost Efficiency

Rocket Lab is working on reusability for Electron’s first stage, which could reduce launch costs and improve margins over time. If successful, this would enhance its competitive positioning and profitability in the long run. Additionally, the Neutron rocket is designed with full reusability in mind, allowing Rocket Lab to further compete with SpaceX on cost and turnaround time.

Risks

Competitive Pressure from SpaceX and Emerging Players

SpaceX continues to dominate the commercial launch industry with its Falcon 9, which offers high payload capacity at lower costs due to its established reusability model. Newer entrants such as Relativity Space, Astra, and Firefly Aerospace are vying for market share in the small and medium-lift segments, posing long-term competitive risks.

Capital Intensity and Profitability Challenges

Rocket Lab is still in a phase of significant capital expenditure, particularly with the development of the Neutron rocket. While revenue growth is promising, achieving sustainable profitability remains a challenge. High R&D costs, infrastructure expansion, and uncertain launch demand could put pressure on financials in the near term.

Dependence on Government Contracts

While government and defense contracts provide stability, reliance on these contracts also poses risks. Budget cuts, shifts in space policy, or changing geopolitical alliances could impact the flow of government funding and create volatility in Rocket Lab’s revenue streams.

Technical and Operational Risks

As with any space company, technical failures, launch delays, or mission anomalies can affect Rocket Lab’s reputation and financial performance. Developing and testing the Neutron rocket presents engineering risks that could lead to schedule slips or cost overruns.

Macroeconomic and Market Risks

Broader economic conditions, such as rising interest rates and capital market fluctuations, could impact Rocket Lab’s ability to raise funds for expansion. A downturn in the financial markets could also negatively affect investor sentiment toward high-growth, capital-intensive companies like RKLB.

Rocket Lab Covered Calls

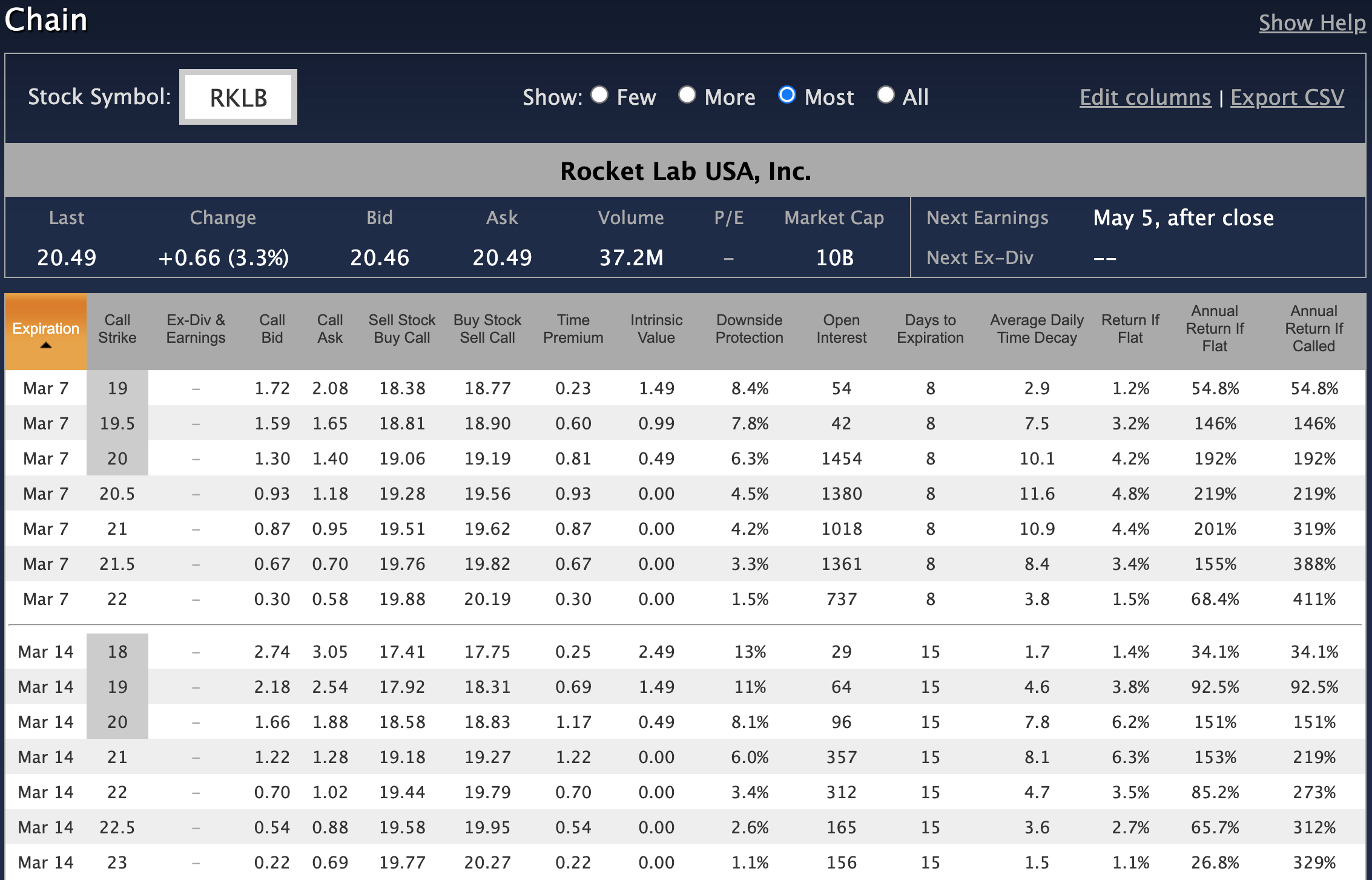

Having said that, if you're not faint of heart, the covered call premiums are fairly high on RKLB. The weeklies are traded enough for quick fills, and offer 4.2% in premium for 1 week out (20-strike, slightly in-the-money), which is 192% annualized. Even the in-the-money strike of 19 offers a 54% annualized gain, with 8% downside protection:

For example, looking at the first row of the option chain table above, you could buy the stock at 20.49, sell a March 7 expiration, 19-strike for 1.72 (or more, with a limit order at the midpoint), for a net debit of 18.77. If called on Friday you make 23 cents/share. Divide by capital-at-risk of 18.77 and your flat return is 1.2% in 5 days, or 54.8% annualized. Or, if you're able to sell the call at the midpoint of the bid and ask, 1.90, then your net debit is 18.59; and if called at 19 on Friday then you make 41 cents/share. Divided by 18.59 and your weekly return is 2.2% in 5 days, or 161% annualized.

Compared to SpaceX

SpaceX is not publicly traded, but we do have some data. 2024 revenue of $14B, but about $8B was StarLink, so let's say $6B for non-StarLink revenue last year. SpaceX has an approximate valuation of $350B (based on a private tender offer). Since 42% of revenue was non-StarLink you could estimate that the non-StarLink part of SpaceX (the part that competes with RKLB) is worth $150B. That's really back-of-the-envelope kind of math since we don't know the relative growth rates or margins of each business. But, nonetheless, SpaceX is worth around 16x RKLB's current market cap. Or, said another way, RKLB has room to grow.

Mike Scanlin is the founder of Born To Sell and has been writing covered calls for a long time.